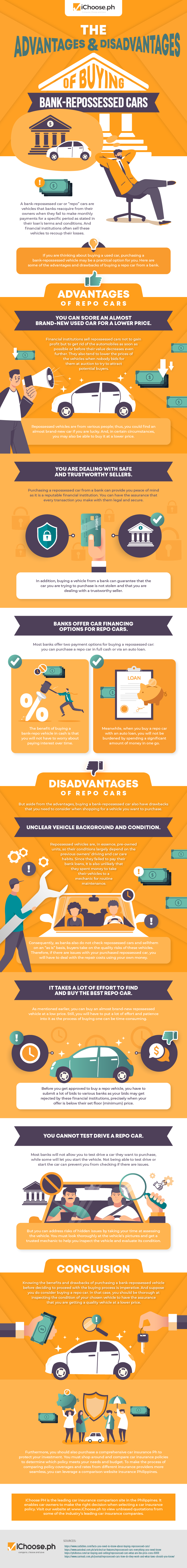

When car owners fail to make monthly payments for a specific period for a car acquired through a car loan, banks repossess cars—often termed a “repo,” financial institutions take the vehicles back to recoup their losses.

So, if you are thinking about buying a second-hand car, a repo car may be a practical option for you, and here are some of the advantages and disadvantages of purchasing one:

Advantage 1: You can score an almost brand-new used car for a lower price.

Car financiers sell repossessed cars before vehicles ‘ value decreases to get rid of cars in the soonest possible time. Prices are lowered to a certain extent when no one bids for the car from potential buyers. So, if you are lucky enough, you can buy an almost brand-new car at a very affordable price.

Advantage 2: You are dealing with safe and trustworthy sellers.

Many people quickly purchase repossessed cars from a bank for peace e of mind knowing that it is from a trustworthy financial institution. The assurance that transpires in the transaction assures the buyer that the transaction is secure and legal. Some vehicles underwent comprehensive car insurance in PH to guarantee that the car is not stolen and that the deal is decent.

Disadvantage 1: Dark vehicle background and condition.

Since repo cars are pre-owned units, the car’s condition is highly dependent on the previous owner’s care habits. Usually, when car loaners fail to make payments, it simply means that car maintenance while it is in their possession is unlikely possible.

Disadvantage 2: It takes a lot of effort to find and buy the best repo car.

Though there are many almost brand-new repo cars, it would still require much effort and patience. As a buyer, the process of buying—paper works—is very tedious and time-consuming; to add, a bank-repossessed car cannot and will not be available for a test drive.

Read More: Advantages of Joining a Car Club

Learn more about bank-repossessed cars through this infographic.